Blockchain in Islamic finance

This article explores the basics of blockchain technology and its possible applications in the Islamic finance ecosystem.

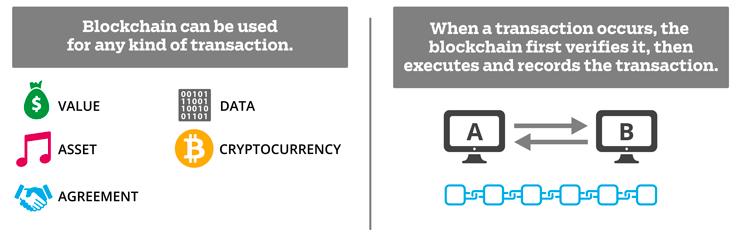

A new technology in computing is set to revolutionise the world in ways that we never thought possible. Enter blockchain, a distributed ledger which facilitates the transfer of value or data without the need of a central authority or a third party.

The potential of blockchain is so powerful that hundreds of financial institutions across the Organisation of Islamic Cooperation (OIC) countries are jumping on board and pursuing solutions relating to the blockchain system. In fact, Dubai has unveiled its plan in becoming the leader of blockchain utilisation across its private and public sector by 2020. It is no surprise that governments are having a keen interest in blockchain technology. Let’s dig deeper into what blockchain really is.

What is blockchain?

The blockchain is a decentralised digital ledger which records transaction chronologically and publicly, allowing anyone to verify and access the data. The blockchain is the underlying technology that powers bitcoin, a decentralised digital currency which is the first and original application of blockchain. Imagine sending money from anywhere in the world at little to no cost, with no banks or third-parties involved in the transaction. Seems impossible? Well, blockchain and bitcoin allows you to do just that. The use for blockchain is limitless; it can cater to any form of transactions involving value such as money, property and goods.

In 2008, an individual (or a collective) under the pseudonym Satoshi Nakamoto published a white paper on how bitcoin would work, along with the open-source software needed to run the protocol the following year. His invention has sparked the blockchain revolution, without anyone knowing who he is.

Is blockchain secure?

blockchain’s security protocol is effective since it relies on 2 important characteristics;

- Use of cryptography

- blockchain uses cryptographic techniques backed by complex mathematical algorithms to verify and secure the data

- Nature of decentralisation

- It is much harder to hack a decentralised network rather than a centralised, single-point-of-failure system. Imagine the amount of work needed to hack into thousands of computers distributed in a decentralised network!

What’s impressive with blockchain is that the level of security rises the longer the chain gets. This is because a tremendous amount of computing power is required to “hack” or alter the information in the blocks. As the chain grows longer, the amount of computing power needed to “hack” them increases exponentially. In addition, the features of immutability and transparency of the blockchain process removes the possibility of fraud and theft.

Application of blockchain in Islamic Finance

The use of blockchain technology holds great potential across the Islamic finance industry. The possibilities include:

Smart contracts

In the pursuit of avoiding interest, speculation and uncertainty, Islamic finance leverages on a wide range of contracts such as profit-sharing agreements, partnerships and agency arrangements. For example, an average financing arrangement requires 3 or more contracts involving multiple parties (agency contracts and multiple sales contracts). In contrast, a conventional loan agreement requires only a contract between the bank and the borrower. Hence, the need for more contractual arrangements in Islamic finance transactions equates to higher administrative and legal considerations. This may ultimately increase costs for the end user. (See also: Can Islamic Finance Serve 2 billion Muslims?)

An exciting technology from blockchain called smart contracts aims to redefine how contracts work. Smart contracts are essentially self-executing digital contracts. The terms of the contract are electronically coded and will execute only if the conditions are met. This automates the entire contractual process for Islamic institutions, alleviating the additional administrative and legal complexities and redundancies. Not only that, smart contracts are easy to verify, immutable and secure. They naturally mitigate operational risks arising from settlement and counterparty risks. All in all, smart contracts would streamline the operations of Islamic financial institutions and automate the entire contractual process.

Distributed cloud storage

Currently, almost all cloud storage services link to a centralised server. A centralised database runs the risk of compromising the data from a single point of entry. Hence, users need to have trust in the single provider. A decentralised system eliminates the risk of conflict of interests and/or moral hazards between participants. Within a decentralised network, one needs only to trust the static protocol of the blockchain, governed by cryptographic mathematical algorithms. The universal laws of mathematics are absolute and thus undoubtedly credible.

Blockchain’s distributed cloud storage can seamlessly manage the huge amount of data and information from Islamic institutions. Decentralised data storage offers two main advantage; security and cost efficiency. As of now, data storage in institutions is centralised and manually managed. This is inefficient and runs the risk of single-entry cyber attacks or data loss. Distributed storage would thus eliminate the need for documentation and manual reconciliation of transactions.

Digital currencies

The emergence of blockchain technology is in tandem with the advent of cryptocurrencies, in particular, bitcoin. Hence, it is only fair that we examine both elements individually to explore their compatibility with Islamic finance.

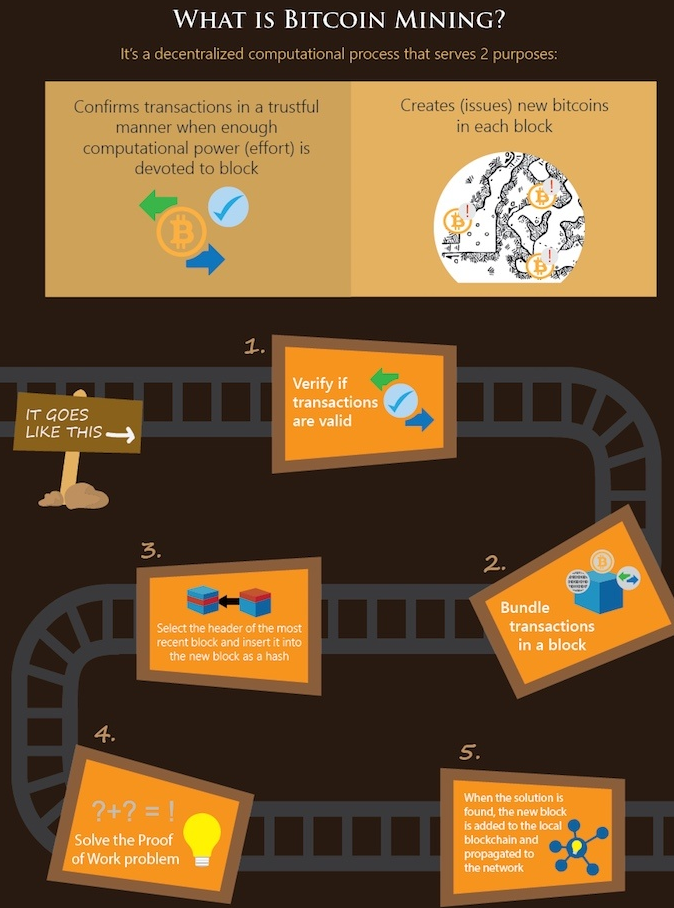

Unlike fiat money, cryptocurrencies cannot be made out of thin air. A huge amount of effort and resource is required to produce the supply of cryptocurrencies like bitcoin. This is called “mining”, where individuals or entities use sophisticated computer equipment and software to solve complex mathematical problems through the use of cryptography. This process creates 2 outcomes:

- Ensure the security of the entire network

- Creation of cryptocurrency supply as a reward for miners’ efforts

Photo credit: bitcoinmining.com

Since the blockchain is a decentralised network, miners have an important role in securing transactions. Their interests will naturally be aligned since miners will be rewarded with cryptocurrencies for every successful block they secure. The exertion of computing power, electricity and time by the miners represents the value that validates the creation of cryptocurrencies. This is contrary to the fiat system, where governments and banks can create money out of impulse with no corresponding injection of value. It is important to point out that fiat money is debt-based. It follows that whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.

In the perspective of Islam, money should possess an intrinsic value and is ideally asset-backed. Cryptocurrencies such as bitcoin can be seen to be more Islamically-inclined since it is backed by real value. Therefore, as currency, cryptocurrencies are intrinsically compatible with Islamic finance.

The innovation of blockchain technology enables us to imagine a world where we do not have to agonise about whether we trust a government, bank or any system where human error is possible.

In summary

The blockchain is a revolutionary technology that the Islamic finance ecosystem could leverage to exponentially enhance business processes and streamline operations. blockchain creates the possibility of coordinating institutions’ transactional activities within a strong mechanism of trust and transparency. It is apparent that the characteristics and conditions of blockchain are in alignment with the principles of Islamic finance. In addition, its usage would open the ecosystem to a raft of interesting opportunities. More importantly, blockchain is a perfect medium to incorporate and operationalise Islamic values of justice, equality, trust and fairness into finance which embodies the spirit of the Shariah.

___________________

Source(s):

- Bitcoin: A Peer-to-Peer Electronic Cash System by Satoshi Nakamoto

- The blockchain and Islamic Finance by Hazik Mohamed

This article was first published in EthisCrowd.com