Disrupting Islamic finance

Islamic finance and takaful were the positive disruptive paradigms for financial services back in the 70’s and 80’s, but it has lagged behind. Ajmal Bhatty firmly believes the digital age provides the much-needed impetus for Islamic finance and takaful to achieve its real potential and intrinsic goodness for society, and the real economy. This article was first published in the third edition of In Focus magazine.

Cutting to the chase, let’s acknowledge that one of the main challenges for takaful companies is to make customers aware that takaful is different from insurance. If these companies succeed in delivering the message of takaful’s uniqueness, they’d build the right scale they need and eliminate pricing and reserving inadequacies.

In truth, takaful and Islamic banks weren’t supposed to be insurance companies and just banks. What’s more, digitisation, fintech and insurtech (insurance technology), offer takaful and Islamic finance that golden opportunity to improve as well as overcome the challenges of operational structures, delivery and scale, to become real disruptors of financial services.

What to consider is, mass applications for financial inclusion are possible for two million people in areas and regions that still lack access to basic savings and credit availability. This challenge exists even for countries that have high levels of financial inclusion, where even though majority of people may have basic bank accounts, the financing gap for small and micro- enterprises remains.

With that in mind, organisations such as MassesGlobal LLP, that provides services at micro and macro levels, are needed. This is to ensure financially and socially challenged individuals may take positive steps towards financial independence.

Where lies takaful’s popularity

Right now, Malaysia, Saudi Arabia and the UAE are major players in takaful followed by Indonesia, Pakistan and Egypt. Africa represents one of the fastest growing regions and Turkey is expected to pick up in the near future. However, Malaysia continues to lead in improving governance of takaful at the regulatory and market levels, which is followed by several markets around the world.

Malaysia was the first country to implement risk-based capital framework for takaful and to enforce greater transparency in sales illustrations such as disclosure of wakalah (agency contract) fees with strong regulations on qardh (loan). Other countries such as Saudi Arabia, Bahrain, the UAE and Pakistan also have strong regulatory supervision and governance.

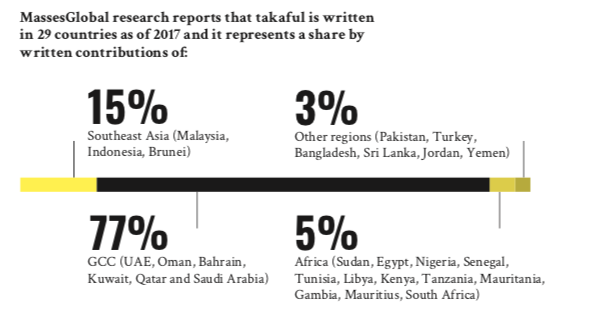

Bear in mind that the Gulf Cooperation Council (GCC) constitutes the largest share of global takaful contributions due to predominance of general lines of business, but Southeast Asia leads with 57 per cent of the global family takaful business.

Why it’s needed

Takaful exists because of what it stands for and it appeals mainly to Muslims. The ethical financial dimension in which it exists is good for all, and the financial as well as economic ecosystem. Islamic finance, reports a recent PricewaterhouseCoopers (PwC) study, is offered in more than 60 countries with total assets of USD2.6 trillion in 2017. According to MassesGlobal research, takaful assets are around five per cent of this.

However, when promoted not just as insurance, but for its uniqueness, it appeals to everyone. This is something that takaful industry hasn’t been doing well and have been focusing by default on just the urban, mid-income Muslims for personal lines and for small, medium and semi-large businesses for commercial lines.

Takaful’s popularity has mostly remained the same except that in recent years the rural segments are being targeted in Africa and to a lesser extent in Indonesia as well as Malaysia. Moreover, the cost- effective digitalised solutions have enabled its penetration into the rural segments, but this is only just beginning.

Digitalisation is the one great opportunity for takaful operators to harness in all areas of their operations from the back office to customer facing activities in order to gain timely traction in the fast-changing world of digitisation generally.

Digital solutions in the Islamic finance realm

Reaching out to the masses has never been easier in the digital age than ever before. Digitalisation has brought about positive disruption to the ways we’ve done things in the past. Digital Society Study reports, by 2020, up to three-quarters of the world will be connected through over 50 billion devices and by 2025 it’ll be more than the number of people on our planet.

Thus, the development of insurtech for business-to-business (B2B) and business-to-consumer (B2C) solutions facilitates not only reaching out to 1.7 billion customers at modest income levels, globally, but also four billion people at the lowest income level, globally, who earn between USD4 to less than USD1 per day. For perspective, the World Bank records 100 million people as top earners with income in excess of USD200,000 per annum.

Furthermore, high operating costs that are driven by legacy systems with workflows and servicing issues, frustrate customers and undermine growth as well as profitability. Insurtech is all about reducing costs and optimising service, resulting in tangible business and customer values. It’s based on data science such as big data analytics and cloud computing, that uses artificial Intelligence such as chatbots and algorithms.

Fintech is generally more evolved than insurtech even in conventional finance. Insurtech is currently at the startup phase but developing fast in applications of cost reduction and customer engagement. Takaful industry needs to catch up to harness its benefits. Takaful through insurtech, or taktech as it’s becoming known, is a perfect fit because of a mutual structure where their virtual participants fund is available to customers looking to insure risks that can be underwritten with proper safeguards through internet and smartphones.

Still, these are early days and there are several factors that need to be in place such as governance and regulations, data protection and cyber security. The way forward in this area is for licensed takaful companies to incorporate insurtech into their structure for cost containment, improved efficiency and scale.

Touching on ethics

What fintech enables, apply to both conventional and Islamic financial systems and provide digitalised solutions to traditional ways of doing things in all areas of business.

Tokenisation through blockchain as a means of investing in assets that otherwise are only available to large institutional investors, opens up possibilities for people to invest directly at the retail level. The use of tokens has made it possible for investors to buy any amount of large assets that involve for example forestry, and to sell at any time, at prevailing market prices. This in turn creates greater interest (demand) in investing in a green ecosystem, enables the build of investor scale and a momentum for faster forestation of the planet.

Ethical solutions through digitisation are facilitated quickly through screening of investments within the ethical paradigms. This encompasses all areas of environment, social and governance (ESG) and embeds ESG risk as well as business best practice factors into stock selection within the principles of shariah and its compliance. The use of algorithms and machine learning maintain the right response to the peer-to-peer (P2P) and B2C needs.

Brushing up standards

I believe, the industry standards for Islamic finance are set at two levels: at the country level, and across countries, at the industry level. At the country level, it’s the licensing authority of the country with specific regulations on Islamic finance and takaful. They exist in several jurisdictions such as the Gulf Cooperation Council (GCC), Malaysia, Indonesia and Pakistan.

At the industry level, it’s namely by, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), and the Islamic Financial Services Board (IFSB).

IFSB has worked with the Basel Committee to develop their standards to bring consistency across financial markets with the important element of recognising the unique nature of Islamic finance.

A recent adoption by International Monetary Fund (IMF) of IFSB standards, for its assessments from 1 January 2019 to address the regulation and supervision of Islamic banks, will bring further financial stability into the Islamic banking system. Furthermore, at the industry level, AAOIFI and IFSB standards steer the institutions to incorporate rules and specificities to attain compliance with shariah principles.

Gaps to fill

One gap that has existed in Islamic finance between the licensing and industry bodies on the one hand, and the institutions on the other, is about shariah rulings and its compliance by institutions driven by their internal shariah advisors. The setting up of national shariah boards or higher shariah authorities has helped to remove this gap to a great extent, but so far, such boards exist only in a few countries.

Another gap is the lack of shariah audit by an external independent body similar to financial auditing. This approach was developed and promoted by the United Kingdom’s Islamic Finance Council and has gained acceptance in several jurisdictions.

Takaful, now and beyond

Although change is happening slowly within takaful’s realm, it is steady. Now, most companies, both conventional and takaful, have apps for customers to engage them and bring them closer to their product providers. Facultative reinsurance can be placed at a fraction of the time previously needed. Motor and medical segments, which are the most capital-intensive risks, are getting increasing attention and investment, which can lead to better profitability, and perhaps, lower premiums.

There are several insurtechs in conventional finance but none yet in takaful, at least not in the Middle East. Life insurance penetration in the Middle East is one of the lowest in the world. Vibe is the first AI driven insurtech app being developed for takaful providers that’ll help improve penetration rates.

I forecast bright prospects for takaful in the coming years, for two reasons. Firstly, there has been now a considerable learning from what works and doesn’t work in the industry. The regulatory environment has been evolving with greater focus on good governance and risk management in building stable, durable businesses. The growing pains of a young industry have resulted in greater activity in mergers and acquisitions for stronger consolidated groups. While the weaker players will be absorbed or disappear.

Secondly, it’s the digital factor that’ll transform takaful as takaful, and not just as insurance. This encompasses its mutuality and social aspects. The mutual companies in conventional finance have been doing that successfully for decades. There are 16 million Muslims in the EU where banking and insurance penetration is one of the highest in the world – this would be one area to watch out for. Also, Africa is moving fast in takaful and there’ll be greater momentum in Pakistan as well as Turkey, plus new markets are likely to emerge such as Afghanistan and Iraq, if peace happens.

___________________

For more on the latest topics related to business, technology, finance and more, read our digital versions of In Focus magazine, issue 1, issue 2 and issue 3.

Photo by Michael Longmire on Unsplash.

About the Author

About the Author

Ajmal Bhatty has managed companies on two continents and several countries. He is presently consulting actuary based in Dubai and managing director of MassesGlobal LLP, a company based in London, established in 2017. Its primary aim is to promote and develop ethical use of money for the common good. Ajmal has extensive experience and knowledge in Islamic finance, serving several boards of finance-related companies. He has in-depth experience in startup ventures and bancassurance and has been involved in offshore global processing centres in Malta, Bermuda as well as India. Ajmal’s committed to finding ethical solutions in today’s digital age of insurtech and fintech.