Prevention better than cure

Fraud in financial institutions is one of the major problems costing banks millions. Co-founder of Kratos Innovation Labs, Satheesh Kumar Paddolker sought solutions to prevent financial fraud using blockchain technology.

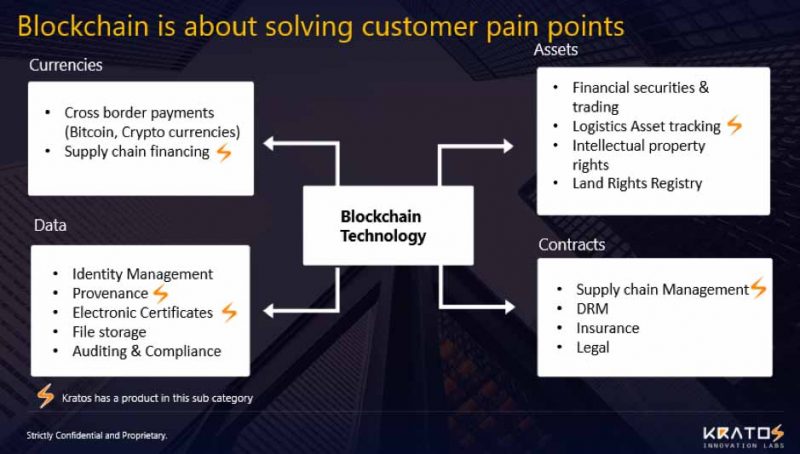

Though the initial hype surrounding blockchain was about cryptocurrencies, this technology is capable of achieving much more. The advent of blockchain technology is changing our world yet again. Blockchain technology researchers are already looking at how to efficiently apply this technology in areas such as fraud prevention especially since the finance industry is looking for solutions.

Today, banks and financial institutions remain at high risk of fraud, especially in India. According to a recent report by PricewaterhouseCoopers (PWC) on fraud cases in the banking sector, figures show that fraud cases will continue threatening banks unless something drastically changes. Human errors are partly to blame but they can also be avoided.

42-year-old Indian entrepreneur and co-founder of the fintech startup, Kratos, Satheesh Kumar Paddolker came up with a solution to prevent financial fraud and save banks millions using blockchain technology. As a certified financial technologies specialist from the Massachusetts Institute of Technology (MIT), Satheesh and co-founder Dr Rajiv Kaushik founded Kratos Innovation Labs in Singapore in 2016. His understanding of financial technologies that he gained at MIT helped him design products to solve customer pain points in the areas of financial fraud and counterfeiting. Through his innovations, he cuts across the board offering products to various business sectors.

As a graduate in financial technologies, Satheesh currently works on the research and development of blockchain technology at Kratos Innovation Labs with a focus on optimisation of a blockchain network. The basic concept of applying blockchain technology is to help maintain accurate, legal transactions and prevent fraud.

Blocking human errors

One of the issues Kratos tackles is basically ensuring that manual checks and human errors are not made. With blockchain technology, there are no loopholes and contracts can’t be altered. This is one of the ways fraud attempts are blocked.

As a certified financial technologies specialist, Satheesh was able to design multiple products using blockchain technology. His initial focus was on financial fraud prevention which made him create his first product, x-DeFraud. Though x-DeFraud focuses specifically on fraud prevention in trade finance, Satheesh has designed other products for other industries susceptible to fraud like his product Block Provenance, which prevents counterfeits in the food, automotive and pharmaceutical industries.

Fraudsters and scamming ways appear differently in different industries. ‘Some of the documentary fraud instruments are duplicate invoices, warehouse receipts and letter of credit. Fraudsters use these to seek multiple loans in multiple banks using the same invoice or warehouse receipts multiple times. They make use of the loopholes where the financial institutions don’t share transaction information. For example, if bank A finances an invoice, bank B wouldn’t immediately know that the invoice has already been financed. X-DeFraud can alert bank B within minutes about the earlier loan granted on the invoice/warehouse receipt,’ Satheesh explains.

Transparency and security

Seeing that the market needed more, Satheesh also expanded Kratos by developing products such as Smart Contracts as a Service (SCaaS). SCaaS follows a similar model to an SaaS model which is a centrally hosted licensing and delivery model used in businesses.

These smart contracts are computer protocols that digitally facilitate and verify performance of a contract similar to traditional contracts but it enforces obligations automatically. They execute functions that get triggered by an event and are stored on a blockchain network which provides transparency and can not be tampered. ‘No central authority can control them,’ Satheesh points out. ‘They get executed when a mutually agreed clause gets triggered, providing transparency and trust to the participating parties,’ he explains.

It might sound a little unsecure for financial institutions to allow an external product to manage and monitor their transactions. However, Satheesh maintains that it’s very secure because they don’t need to access sensitive information of banks at all.

‘Apart from storing highly encrypted information, intrusion detection systems are in place to look for any intrusions into the highly secure blockchain network that hosts the shared ledger,’ he says.

Adding to that, Satheesh doesn’t need to ask for banks or financial institution’s sensitive information because their product is installed in a demilitarised zone (DMZ) network. A DMZ is a subnetwork that adds an additional layer of security to an organisations network which works apart from the firewalled local network.

The minimal information that they require the financial institutions to share, on a blockchain network, is encrypted using secure encryption algorithms. ‘We require banks or financial institutions to export non-sensitive information of a funded financial instrument. For example, we’d require minimal details of an invoice that was funded by a bank,’ he explains.

‘Our system monitors for any external intrusion into the blockchain network. Institutions can also monitor their transactions, if they want,’ he adds. Though there may be many solutions out there, Satheesh believes x-DeFraud uses better technology with blockchain to prevent fraud that would interest financial institutions.

Last words

Blockchain technologies are storming into the fintech industry and can be used for settlements of smart assets, remittances, digital identity and more. This is only the beginning. X-DeFraud is currently on a minimum viable product (MVP) level which means the product is at the early stage where it has just enough features to satisfy early customers. Kratos Innovation Labs are continuing their research and development of their products. ‘We’re in talks with multiple financial institutions to run pilots before we can implement it in production,’ Satheesh ends.

___________________

Photo Credit: Liam tucker on unsplash