2024 Global Economic Outlook: Trends and Growth Opportunities

An in-depth analysis of the world economy in 2024 by Neha Anna Thomas, Associate Director – Economic Analysis at Frost & Sullivan, uncovering economic predictions, emerging trends and growth opportunities shaping regions worldwide. Gain valuable insights into key economic indicators and strategic recommendations to navigate the evolving landscape. This article is part of In Focus special issue.

The world economy has had to navigate a series of shocks in the recent past, beginning with the US-China trade war which rattled global supply chains and the onset of the pandemic which led to deep economic contractions. Also, the Russo-Ukrainian war which pushed up energy costs and further disrupted trade as well as supply chains.

Central banks world over had to undertake a delicate balancing act last year to curtail surging inflation levels while not raising interest rates towards levels that would push economies into recessionary territories. 2023 data, nonetheless, points to the economic resilience of the world economy despite challenging times. Initially predicted recessionary expectations were largely avoided and global economic estimates for 2023 were revised upwards on account of better-than-expected performance.

Mild Global Slowdown Expected for 2024, Emerging Market Economies to Lead Growth

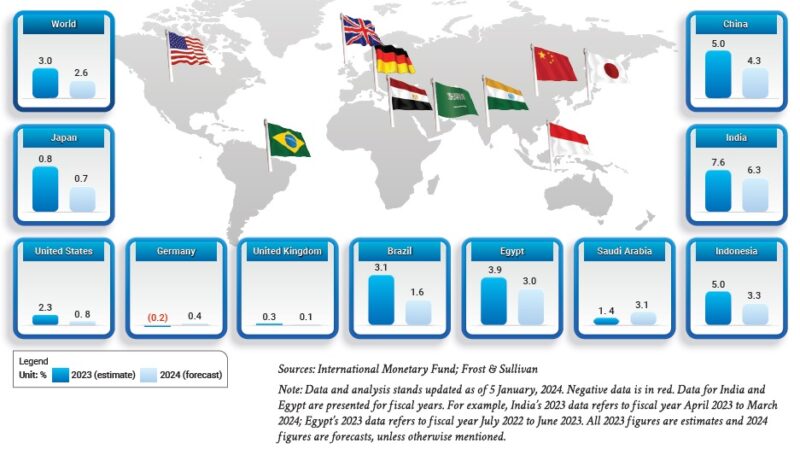

With lingering pressures from factors such as the Russo-Ukrainian war and now the Israel-Hamas war, as well as elevated interest rates, global GDP growth is expected to slow from 3.0 per cent in 2023 to 2.6 per cent in 2024[1]. The group of emerging market and developing economies will retain growth at around 4.0 per cent into 2024, while advanced economies register just 1.0 per cent growth.

GDP Growth, Global, 2023 and 2024

The US will face restraints emerging from a combination of factors including raised interest rates and the restart of mandatory student loan repayments, because of which weak 0.8 per cent growth is forecast for 2024. Growth in Western Europe will also be constrained, as seen from data for Germany and the UK. China’s growth will weaken from 5.0 per cent in 2023 to 4.3 per cent by 2024 as the economy comes under pressure from muted business confidence, the property crisis, as well as weak external demand.

Growth across Middle Eastern economies, including Saudi Arabia, the UAE, Kuwait and Oman, will be restrained in H1 2024 as a result of oil production cuts to match waning demand. Economic diversification, however, will continue to gain momentum, with non-oil GDP continuing to play a key role in supporting the growth trajectory of Saudi Arabia and the UAE.

Asia Pacific will be the region witnessing solid growth of 4.0 per cent in 2024, despite weakness emerging from China. Major economies such as India, Vietnam and Philippines are expected to register over 5 per cent growth.

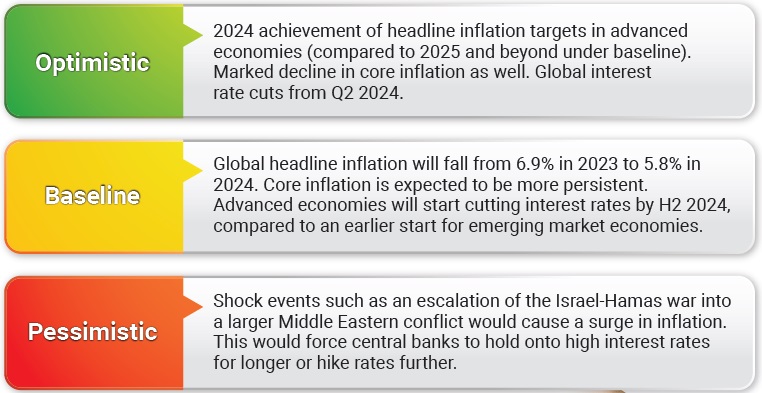

Reversal of Tight Monetary Policy in 2024

Central banks have had to hike interest rates drastically to quell inflationary pressures. As a result, headline inflation (including energy, food and other volatile items) is successfully seen to be coming under control – central banks, therefore, now have some leeway to reverse tight monetary policy conditions. In the US, for example, headline inflation declined from 3.7 per cent in September 2023 to 3.2 per cent in October 2023, with inflation forecast to continue to trend lower in 2024. The fall in global core inflation – excluding energy and food – on the other hand, is expected to be modest.

With headline inflation falling, advanced economies are expected to largely start cutting interest rates by the second half of 2024 or H2 2024 (an earlier start is also a possibility under optimistic conditions). In the United States and the United Kingdom, for example, the key interest rate is expected to be held steady at the current level of around 5.0 per cent in H1 2024, followed by rate cuts in H2 2024.

Scenario Projections for Inflation and Interest Rates, Global, 2024

Source: Frost & Sullivan

Source: Frost & Sullivan

Emerging Growth Opportunities for 2024 and 2025

Robust growth from Asian economies such as India and Vietnam will intensify the China+1 supply chain pivot into India and ASEAN (The Association of Southeast Asian Nations), whereby companies maintain presence in China while continuing to expand into locations which offer higher growth, manufacturing incentives and stable policies, among other factors. Manufacturing FDI inflows into these economies should therefore receive a boost, creating growth opportunities across local value chains as well.

A combination of the high inflation levels and high interest rates and the 2022 to 2023 cost-of-living crisis would have restrained big-ticket purchases, as households focused on managing essentials. Now, as central bank interest rate cuts start to take shape from 2024, general interest rate levels, including on car loans and mortgages, will start to ease from end-2024, continuing into 2025. Once borrowing costs fall and inflation becomes manageable, more housing demand and vehicle purchases can be expected. Businesses should be prepared for demand revival in these segments.

Business opportunities linked to sustainable growth and development will continue to mount as countries continue to prioritize clean energy policies and green growth. Cross-border and cross-industry partnerships for critical minerals will be a top theme shaping the global economy in 2024.

In a Nutshell

In summary, while global economic slowdown is anticipated for 2024 overall, some turnaround and recovery can be expected especially towards H2 2024 with the support of interest rate cuts and demand revival. Global growth could also defy expectations and surprise in 2024, similar to the trend in 2023, under more optimistic scenario conditions driven by factors including additional fiscal support in China or earlier-than-anticipated interest rate cuts and consumer demand resurgence.

[1] Global economic data and forecasts are highly volatile and subject to changes based on policy, geopolitical changes, and other factors. Estimates and forecasts in this article are based on prevailing global economic conditions from early January 2024.

Images from Unsplash