Role of Islamic Green Finance in Building a Sustainable Future

Uncover the transformative potential of ethical finance to propel global sustainability efforts forward. Explore innovative strategies and actionable recommendations in this comprehensive analysis by Rituparna Majumder, Industry Principal – Economic Analytics at Frost & Sullivan. This article is part of In Focus special issue.

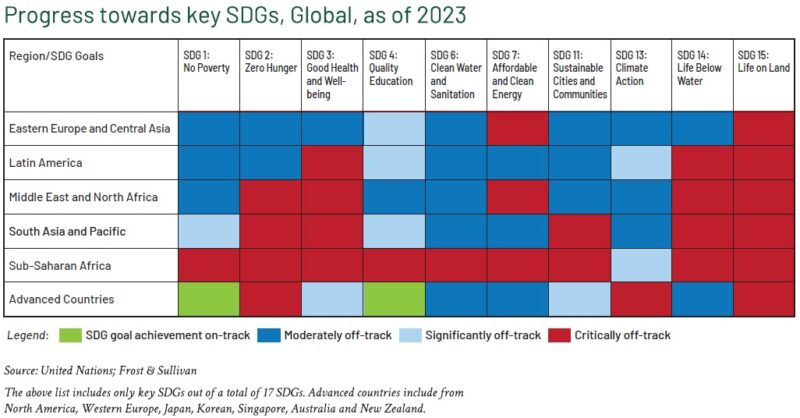

Sustainability-driven investment inflows have increased over time, especially post-pandemic. However, this growth has been skewed more towards major developing markets (over 80 per cent), especially characterised by investments into agriculture and clean energy. With only seven years left to achieve the 2030 SDGs, emerging market economies are well behind in meeting SDG targets, as highlighted in the below chart.

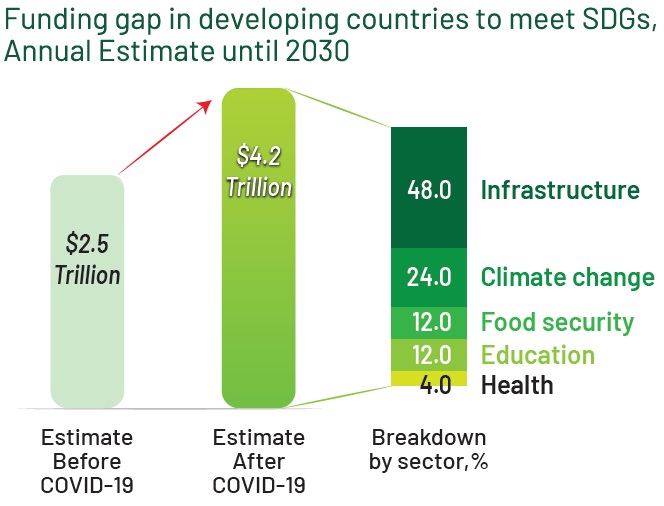

Limited funding is a critical restraint causing delays in SDGs achievement, with USD5 to USD7 trillion needed annually[1] to achieve the SDGs. Moreover, the pandemic exacerbated the gap between funding demand and supply, particularly in emerging market economies, where the funding gap has grown by USD 1.7 trillion annually.

Achieving the Paris Agreement climate targets and SDGs require countries to undertake urgent policy measures and implement a robust green finance[2] framework, as well as align with green taxonomy standards. Businesses also play a pivotal role in meeting SDGs through aligning investments with SDGs to create profitable and impactful opportunities in new markets and business models. The prevalent funding gap offers huge opportunity to sustainable finance market players in emerging economies.

The Close Association Between Islamic Finance and Green Finance

The integration of Islamic finance principles with green finance aims to promote sustainability through ethical and fair practices, rooted in the principles of shariah. This synergy offers a significant value proposition through the role of Islamic finance initiatives in combating climate change among the OIC member countries. While institutional investors increasingly seek responsible investments, there is limited availability of shariah-compliant green financial tools globally. To foster Islamic green finance[3] growth, government backing in the form of transparent reporting guidance, for example, is crucial to boost issuance.

The ESG Mandate and Growth of Islamic Green Finance

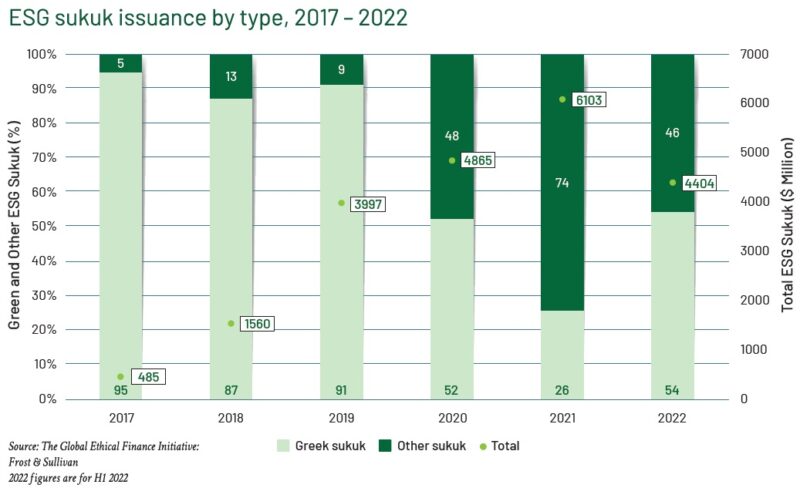

ESG sukuk can be classified into green sukuk (renewable energy and utility related), social sukuk (infrastructure, housing, workforce related), sustainability sukuk (a combination of green and social), SDG-linked sukuk (to achieve a certain SDG target), transition sukuk (to reduce firms’ carbon footprint) and blue sukuk (marine related). Even before the COVID-19 pandemic, green sukuk had seen huge growth momentum, more than doubling in 2019.

[1] United Nations

[2] ‘Green finance covers the financing of investments that would generate environmental benefits including reducing all types of pollution and greenhouse gas (GHG) emission, improving energy efficiency such as wind energy as well as taking measures to mitigate climate change.’ – Islamic Green Finance Development, Ecosystem and Prospects, World Bank

[3] The provision of financial services in accordance with shariah Islamic law, principles and rules: Islamic Finance and the Role of the IMF

The pandemic not only amplified the adoption of sukuk, but also reshaped market dynamics, leading to a surge in sustainability sukuk issuances in tandem with the broader ESG bond market. As shown in the exhibit, green sukuk accounted for 26 per cent of the total value of ESG sukuk issued in 2021, a decline from 91 per cent in 2019, influenced by the focus on social funding during and after the COVID-19 recovery.

Nevertheless, the significant increase in total ESG issuance, soaring from just USD0.4 million to over USD6 million by 2021, strongly indicates the future growth potential of ESG sukuk, underlining the necessity for other ESG sukuk types (not just the green one), imperative. Looking ahead, as funding needs create a significant opportunity for ESG sukuk, the Islamic Finance Council UK (UKIFC) estimates that by 2025, the ESG sukuk market could be worth between USD30 billion to USD50 billion.

Global Prospects of Islamic Green Finance

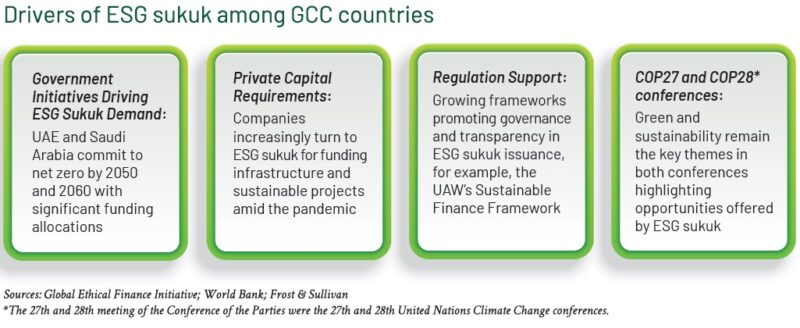

In the Gulf Cooperation Council (GCC), green and sustainability sukuk have dominated ESG debt issuance, comprising 80 per cent of GCC-based issuances, with the alignment between ESG and shariah principles helping to attract a wider investor base. With significant investments planned over the medium to long term in renewables and social development, GCC markets, especially that of the UAE and Saudi Arabia offer growing ESG opportunities aligned with economic diversification goals. Corporates in the region are integrating ESG principles, responding to both domestic development plans and pressure from international investors seeking ESG-linked products, potentially opening access to global capital markets.

- In addition to GCC countries, other OIC member states such as Indonesia and Malaysia have emerged as key ESG sukuk markets. As per ADB estimates, developing Asian countries require USD26 trillion worth of investments (from 2016-2030) across power, transport, telecommunications and water sectors, indicative of a huge medium-term sukuk opportunity.

- As of July 2022, Kazakhstan’s ESG market reached USD250 million. The Astana International Financial Centre (AIFC), Kazakhstan’s Green Finance Centre, is a key stakeholder in ESG initiatives.

- Pakistan might be the first country to issue nature bonds[1], with the potential to raise up to USD1 billion.

Key Policy Recommendations

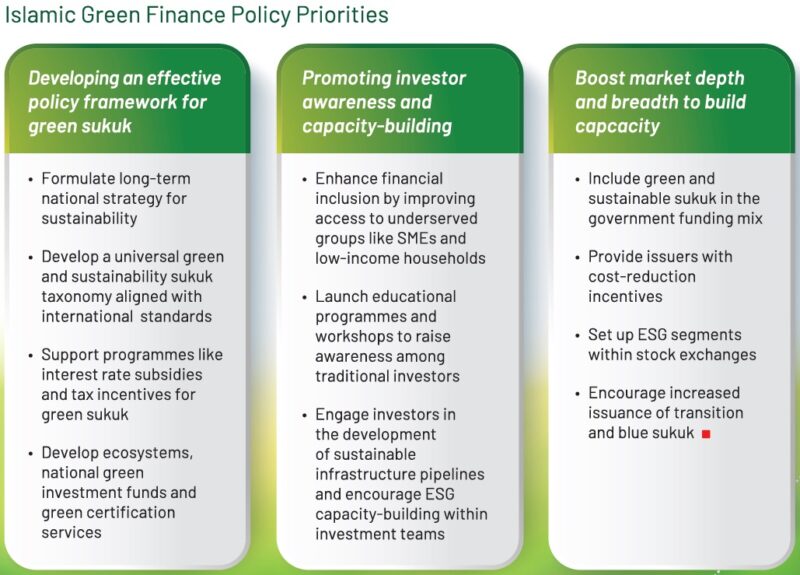

The below exhibit outlines key policy priorities which are important in the acceleration of sustainable finance flows and development of the green sukuk market.

At present there is limited understanding of ESG sukuk in the market. Issuers need to develop frameworks aligning with global best practices such as Green Bond Principles, requiring new skills and processes alongside shariah compliance. Globally, the contribution of both public and private entities is pivotal in establishing standards and guidelines for the green bond market and in driving the expansion of Islamic green finance.

The Sustainable and Responsible Investment (SRI) sukuk framework introduced by the Securities Commission Malaysia (SC) and the active advocation for SDG-alignment and sustainability among Islamic banks by the General Council for Islamic Banks and Financial Institutions (CIBAFI) in the GCC chart out clear roles of the capital market in driving global sustainability agenda. Key market players such as the Indonesian government, Saudi Electricity Company and Islamic Development Bank are seen to be setting benchmarks by issuing large-scale global green and sustainable sukuk.

[1] Nature Performance Bond (NPB) is a proposed green financial instrument to link issuances to biodiversity and ecosystem restoration

Images from Unsplash