Economic Centre of Gravity Shift: Follow the Money

Socioeconomic tailwinds propelling economies of the East – share in global GDP to outpace the West by 2030 by Aroop Zutshi, Global Managing Partner of Frost & Sullivan. This article is part of In Focus special issue.

The West, particularly Europe and North America, has been the epicentre of wealth creation, trade and innovation for centuries. However, the tides are turning, with global emerging markets (EMs) becoming the new frontier of economic prowess. In 2001, Foreign Direct Investment (FDI) inflows in the developed economies were 2.6 times that of developing economies. More than two decades later, in 2022, developing economies raked in USD916 billion in FDI compared to advanced nations’ USD378 billion.[1]

The East[2] is on the precipice of an unprecedented economic boom. With a combined population of 3.76 billion, burgeoning economies and steady GDP growth coupled with robust manufacturing and technological ecosystems, the likes of China, India, ASEAN[3] and the GCC[4] are not merely participants in this tectonic shift – they will be the architects of a new world order.

A Confluence of Economic, Demographic and Technological Megatrends are Driving the Eastward Pivot and Fostering Multi-sector Growth Opportunities

Several global megatrends such as offshore manufacturing, exploding middle class with rising purchasing power, coupled with expanding policy focus on sustainability and decarbonisation and digital transformation have been transforming the global socio-economic fabric over the past two decades.

Structural as well as Supply Chain Transformations and Manufacturing Take-off

China became a global manufacturing hub owing to its huge labour pool and talent base, low production costs, and attractive economies of scale. In 2019, China’s manufacturing value added as a percentage share of GDP stood at 27 per cent, far outstripping the global giants Germany and United States at 20 per cent and 11 per cent, respectively.[5]

Moreover, Vietnam, Philippines, Malaysia, Indonesia and India have undergone massive structural transformations in the past 15 years and have rapidly industrialised. As a result of their local manufacturing prowess, they are widely benefitting from the recent China de-risking trends and the increased focus of global conglomerates on building multiple sourcing and production lines. Recently, we are also witnessing China increasing its role in high-tech production.

Pharmaceutical (China, India); chemicals (China, South Korea); semiconductors (China, Taiwan, South Korea, Japan); automotives and EVs (China, India, South Korea, Thailand); food and beverage (Indonesia, Thailand) and textiles and apparels (China, India, Vietnam) are some of the industries where Asian countries have become the go-to manufacturing, sourcing and exports destinations.

Massive Consumer Base with a Rising Purchasing Power

In 2022, the combined population of the East stood at 3.76 billion, which is forecast to surpass 3.87 billion by 2028 as per the IMF. Coupled with the massive consumer base, the region’s purchasing power is increasing manifold. The Gross National Income (GNI) per capita has seen a robust compounded annual growth rate (CAGR) in EMs like India, Vietnam and China at 4.8 per cent, 5.0 per cent and 8.0 per cent, respectively in the 2000-2019 period.[6]

Consumer-centric sectors such as fast-moving consumer goods (FMCG), tourism and wellness, sports, entertainment and recreation have a huge scope for expansion as the East enjoys an expanding middle-class and young consumer base. Almost all nations have set up comprehensive tourism roadmaps to boost the economic contribution of the tourism sector as a part of their structural transformation journey.

Unparalleled Pace of Digital Transformation driving Startup Ecosystem

Possibly one of the best success stories of inclusive digital transformation in the 21st century is India. 46 per cent of the global real-time payments across the world in 2022 were from India, with the Asian giant recording 89.5 million digital transactions, while China, Thailand and South Korea stood at 17.6 million, 16.5 million and 8 million, respectively.[7]

China and India currently hold the second and third global rank with 275 and 65 unicorns.[8] However, the rising prominence of traditionally fossil fuel-dependent economies such as Saudi Arabia and UAE in the technology startups segment can’t be ignored, with forecasts indicating 45 Middle East and North Africa (MENA) startups reaching USD1 billion valuation (unicorn status) by 2030.

With significant entrepreneurial push and regulatory reforms bolstering the local startup ecosystem, coupled with access to a vast young and skilled talent pool, sizable growth opportunities are emerging in fintech, healthtech, edtech, insuretech and agritech sectors.

Global Decarbonisation Warrants Strategic Co-operation with Resource Rich Economies and Regional Manufacturing Powerhouses

Green energy transition journey, requiring steady supply of natural resources like nickel, cobalt, lithium and rare earth minerals, will be heavily reliant on China and ASEAN – because of their natural resource and industrial strengths. For instance, China not only accounts for 70 per cent of mine production of rare earth minerals, but also houses 80 per cent of the global rare earths processing capacities. Indonesia, on the other hand, has 22 per cent of the world’s nickel deposits and happens to be the globe’s largest nickel producer as of 2022.

Manufacturing in the green energy sector, be it for solar panels, electric batteries, or wind turbines will be highly dependent on Eastern nations either for the raw materials, their processing, or their cost-effective manufacturing. The East, owing to its natural resource base and strong internal manufacturing ecosystems, is an integral stakeholder in the futuristic industry value chains.

East will Account for 45 per cent of Global Nominal GDP by 2030 to Become the Epicentre of Wealth Creation

A conducive policy environment, demographic dividend, steadily rising purchasing power, natural resource wealth and long-term digitalisation and manufacturing thrust will ensure that the East, historically known for its lacking economic development and instability, will become the wealth creator of the future. Moreover, innovation in the East will be consumption-driven rather than disruption-driven, wherein the massive demand potential and need for last-mile inclusion will warrant out-of-box solutions to overcome key challenges. Frost & Sullivan expects the East’s nominal GDP to grow at a CAGR of 6.0 per cent in the 2010-2030 period, surpassing USD110 trillion by 2030, with the region accounting for a mammoth 45 per cent of the global economy.

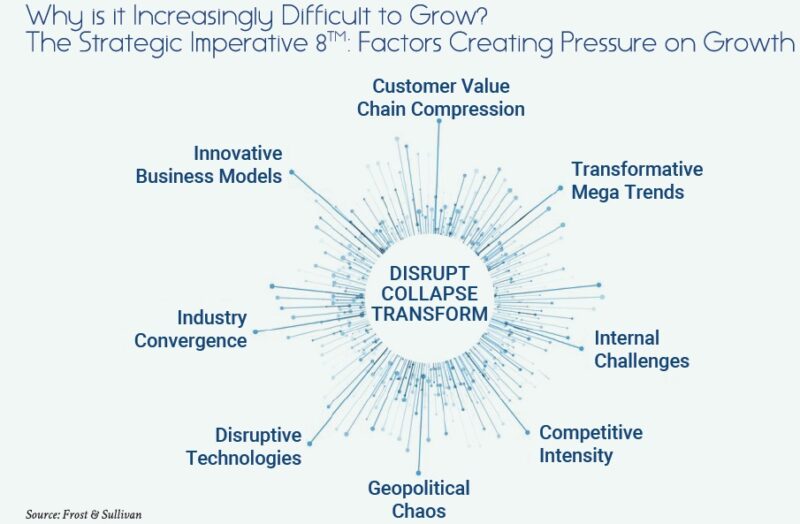

While the megatrends discussed above are tailwinds cementing East’s trajectory towards becoming an economic behemoth – global policy makers, businessmen, conglomerates as well as investors need a comprehensive framework to analyse and navigate the complexities emerging from shifting tides. Frost & Sullivan’s The Strategic Imperative 8™ framework paints a clear picture of the factors creating pressure on growth.

Disruptions being a true constant, entrepreneurial push, rising R&D investments and pace of digital transformation will see innovative business models increasingly coming out of the East, driving global competitive intensity to set new standards. While the transformative mega trends of burgeoning middle class and young consumers in the East need to be capitalised through comprehensive opportunity evaluation and go-to market strategy formulation, the need for compressing value chains to reach the end-consumers faster will mandate firms to diversify their geographical presence.

Additionally, geopolitical frictions in an increasingly multipolar world will continue to push companies to build diversified manufacturing and multi-pronged sourcing and procurement strategies to ensure resiliency. China+1 strategy, stemming from recent supply chain vulnerabilities, has bolstered the likes of ASEAN and India as the go-to manufacturing and sourcing locations.

In the current macroeconomic landscape with fragile geopolitical relations, long-term strategic co-operation will remain key to insulating the world economy. The East, in many aspects, is becoming a safe haven in context of the above challenges, underscoring the fact that the world’s economic centre of gravity is Eastward bound – a trend which will be set in stone, sooner rather than later.

[1] World Investment Report 2023, UNCTAD

[2] The East here includes India, China, Hong Kong SAR, Japan, South Korea, Taiwan, 10 members of ASEAN, and 6 members of the GCC (21 nations combined).

[3] ASEAN stands for Association of Southeast Asian Nations, which includes Myanmar, Cambodia, Brunei Darussalam, Indonesia, Lao PDR, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

[4] Gulf Cooperation Council (GCC) comprises of Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman.

[5] World Bank

[6] World Bank

[7] MyGovIndia

[8] PitchBook Unicorn Tracker

Images from Unsplash