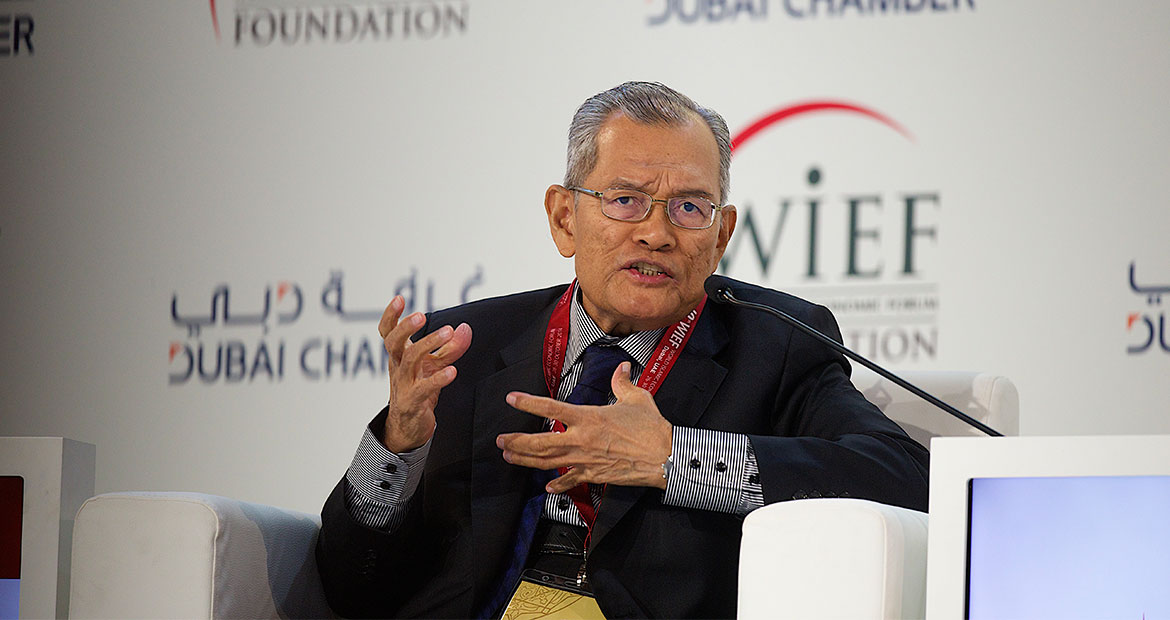

Face-To-Face: With Dr Abdul Halim Bin Ismail

Dato’ Dr Abdul Halim Bin Ismail was awarded The Royal Award for Islamic Finance for his experience in Islamic finance and banking in Malaysia in 2014. The Royal Award recognises Islamic nance visionaries who contribute significantly to the growth of the global economy and social progress of communities around the world. Dr Abdul Halim, the first Malaysian to receive this award is recognised for his pivotal role in establishing the organisational structure and operating procedures of the first Islamic bank in 1983. Among other things, he is a Committee Member of the Shariah Advisory Council of Malaysia’s Securities Commission and Central Bank, Executive Chairman of BIMB Securities Sdn. Bhd, Director of BIMB holdings Sdn. Bhd and BIMB Unit Trust Management Sdn. Bhd and Director of Institute of Understanding Islam, Malaysia (IKIM).

Maryam Nemazee, Journalist and broadcaster, UK, spoke to him about his thoughts and opinions on the potential of Islamic banking. The following are excerpts from the interview.

What is your response to the critics and the sceptics who say that modern day Islamic finance still goes against some of the fundamental principles of Islam?

The banks have Shariah councils and the Shariah councils are manned by people with a high knowledge of Shariah. And also there are international organisations of Shariah, international conferences of Shariah scholars. Of course, there are differences sometimes in terms of interpretation…but they all derive their principles from the Quran, from hadith and from other sources of Shariah. So, to say that it is not in line with Shariah, [then] what is in line?

A casual observer might say that a lot of the products that you have are very similar to those that you have in conventional banking, you offer mortgages, car loans, insurance. The purpose of all these things is the same, it’s just that it is couched in Islamic language.

If you take a chicken and slaughter it according to the Islamic way, then it is halal for Muslims; if not, it is not halal…Now, if you make a curry of the two chickens and I ask you to say which [is which], you would not be able to tell.

Well, in the same manner the products of an Islamic bank might look similar to the products of a conventional bank. The outcome is the same but behind that, the akad, the contracts, are different and the purpose is different.

We were talking a little bit earlier about a book by Harris Irfan called “heaven’s bankers” and in this book he claims that many of the practitioners of Islamic finance have abandoned the true aims in order to keep up with Western banks. Do you agree? Are you concerned with the way it is evolving?

I do not agree…but in a way, what he says is quite correct.

My view is that we Islamic bankers haven’t done our job completely yet.

The Islamic economy consists of three sectors of the population—the Ummah, the government sector, the private sector. [But] there is another sector, which is often left out, and this is the social welfare sector.

And you say that this is where there is a void in Islamic banking, this is an area that they need to expand into. Are there signs that this is happening already in Malaysia? how difficult would it be to get involved in charity?

There are signs that it is happening because at the moment, for the last three to five years, people have begun to talk more and more about the concept of awqaf, whether this could be included under Islamic banking or not. But I have a humble proposal that

Islamic banking and finance should now include the provision of facilities and services to serve the social welfare sector.

I am suggesting that the Central Bank, the monetary authorities, give licenses to Islamic banks, or better still, Islamic banking groups, to set up a sadaqah house as an institution like Syarikat Takaful, to be their subsidiaries whose task would be to collect funds from the private sector.

How would the banks pay for it, would they make a profit on something like this? How would it work?

I am suggesting that the bank should do this at no lost to itself… The bank should collect sadaqah from the private sector. Leave the zakat and awqaf for the government sector because it is already doing it…and we use this sadaqah for various products… The bank would collect sadaqah mainly from the private sector, both institutional and individual. This sadaqah jariyah should not be used to give to the poor and the needy, but used for investment. So, that’s not charity, it’s ongoing investment. Ongoing charity.

Would the banks be able to charge a fee on something like that?

Well, I am suggesting that the bank should be allowed to charge fees and also to distribute the business among its subsidiaries so that it can earn income, like an investment management fee for example. And then the profit derived from the amount invested, that amount is to be given to charity. So, the sadaqah will be an ongoing sadaqah or sadaqah in perpetuity.

I am wondering about perceptions or misconceptions that might be out there about Islamic banking, have you found yourself ever dealing with banks that don’t want to trade with Islamic financial institutions or are worried about it because they might think it would taint their own reputation in some way?

Basically Islamic banks are primarily there to serve Muslims, to do banking along the lines of Shariah [principles]. Actually, when we began Islamic banking in Malaysia, never did we think that it will be utilised in a large way by non-Muslims. This is a development which really surprised me. Within 30 years, a lot of non-Muslims, whether individuals or institutional, have taken up Islamic banking.

It’s been quite a remarkable year for the Islamic finance industry, hasn’t it? We have seen four non-Muslim countries, the UK followed by Hong Kong, South Africa, Luxembourg all selling Islamic bonds or sukuk. Last month, Goldman Sachs issued an Islamic bond, before the end of the year, and I think we are going to have bank of Tokyo-Mitshubishi, Societe Generale do the same. What has sparked this interest in Islamic finance from non-Muslim countries and institutions?

I did not anticipate this…I think the whole world was waiting for an alternative banking system… and they wanted to try. Another thing perhaps, [is that] people are looking at the future and thinking that Islamic countries may be achieving a high level of income in the future and will be a source of funds.

Would you be concerned about the way it is being practised, about distortions

Distortions should be supervised …even at the moment there are differences. When a conventional institution raises funds, in some countries the fund will not be allowed to be utilised for non- Islamic purposes. In some countries, it will be allowed. For those that do not allow the funds, they build up the kind of supervision and the supervisory bodies for that particular financing to make sure that it is not wrongly utilised.

Can you ever really balance or reconcile the true ideals of faith and religion with the need to make a profit?

Yes. Muslims have got to earn incomes for a living and in trade the income comes from the profit. Of course, there is a no profiteering, there is no monopoly and so on and so forth. But profit is legitimate.

But in order to boost profits will Islamic banking have to replicate conventional banks more and more in the products and services that it offers? Many would say that it already does so.

No, I think Islamic banks should be more cautious. Financing is always asset-based and if banks do the sadaqah, if sadaqah becomes a big factor then there is a balance in terms of distributing income.

Do you think that people would have a problem though with banks getting involved in sadaqah, with charity?

I think banks are in the best position to do this sadaqah jariyah. In the first place, sadaqah jariyah involves collecting funds, distributing funds, transferring funds. This is the work of the bank. And then secondly, when the money is obtained, because we stressed sadaqah jariyah is to be invested, [we need] wealth and fund management. This is again the work of the bank, no other institution can do that. Then of course, in terms of integrity,…I would have thought banks…under the supervision of the Central Bank should be very high in terms of integrity as compared to other institutions.

You spoke about Islamic finance and Islamic banking being more cautious. It’s been viewed as being relatively safe, relatively immune to financial crises but the Malaysia-based Islamic Financial Services board recently identified certain institutions that are perhaps overly exposed to assets like real estate in the Middle East. Is that something…to be concerned about?

Yes…these are the pitfalls that banks should look out for. I did say that banks should try to do financing on an asset basis. It might be conservative but it avoids the pitfalls.

Rapid expansion of Islamic banking has been mainly through Islamic sections in conventional banks rather than in pure Islamic banks. Just going back to the question of whether or not Islamic finance could increasingly start to replicate conventional banking, is that not inevitable in some ways given the institutions that it’s being practised within?

This is because Islamic banks have just begun. They are small but there is talk now about setting up mega Islamic banks for the purpose of size, for the purpose of competition.

Even in countries like the Gulf States or in South East Asia, Islamic banking…rarely accounts for more than a third of market share. In Indonesia for example, Islamic banking currently has less than five per cent market share. When you think about the huge untapped Muslim populations in India, Pakistan, Nigeria, Egypt, Morocco, how can the industry realise its vast potential for growth?

That is a very difficult question. In some jurisdictions at the moment, they do not allow Islamic banks to be set up. To the extent that it is allowed, to the extent that Muslims can organise Islamic banks, they will organise. So, I suppose that will slow down the pace but even then as we have discussed earlier, the kind of growth that has already been achieved is quite remarkable.

When you talk about the challenges within countries with vast Muslim populations, many of these rapid growth market countries are facing ongoing political and economic instability. How much of an obstacle is that going to be for Islamic finance growth in these places?

It’s a big obstacle. One thing is that Islamic banking has been developing in Islamic countries in a faster way as compared to political development. In political development there are some difficulties here and there but in Islamic banking a large number of Islamic countries have been step-by-step, as if they are synchronised. Within 30 years, they have achieved the level that they have achieved today. It is quite remarkable.

So do you think in some ways the potential for growth is greater in non-Muslim countries?

No. It is the same.

As the era of cheap money comes to an end, Central Banks are withdrawing stimulus, is that going to see growth slow down especially in the banking industry and could that too affect growth?

Yes, if the era of cheap money stops, yes. But these are economic cycles—whether it is a short cycle or a long cycle, the cycle will come back.

___________________

This report is based on a 10th WIEF session.