Islamic finance in the United Kingdom

International Strategy Advisor to the TheCityUK, Wayne Evans, explains the benefits of Islamic finance in the United Kingdom and looks at its bright future.

‘Although Islamic finance is a small part of the finance industry in the United Kingdom, it’s one of the fastest growing segments,’ says Wayne Evans, International Strategy Advisor to the TheCityUK.

‘The UK’s Islamic finance expertise combined with the measures taken by Her Majesty’s Government have enabled the United Kingdom to become the leading western hub for Islamic finance. The potential, especially in domestic retail banking, is excellent,’ he adds.

Islamic finance in the United Kingdom

Besides catering to the Muslim community, the Islamic finance industry is creating jobs for people in the United Kingdom. According to Wayne, over 2.3 million people work in this sector, two thirds outside of London, generating a trade surplus worth GBP81 billion.

Adding that Islamic finance investments have helped with the United Kingdom’s needs for infrastructure funding, transforming the skyline in London. ‘Our commitment to shariah-compliant systems has helped make the United Kingdom an attractive destination for Muslim investors,’ he says.

The United Kingdom has witnessed many changes and developments in recent years such as the introduction of retakaful services. According to a World Bank publication, Takaful and Mutual Insurance: Alternative Approaches to Managing Risks, retakaful is basically takaful for takaful companies like reinsurance is insurance for insurance companies. The main difference is that retakaful, unlike conventional reinsurance, adheres to shariah principles like providing interest-free liabilities.

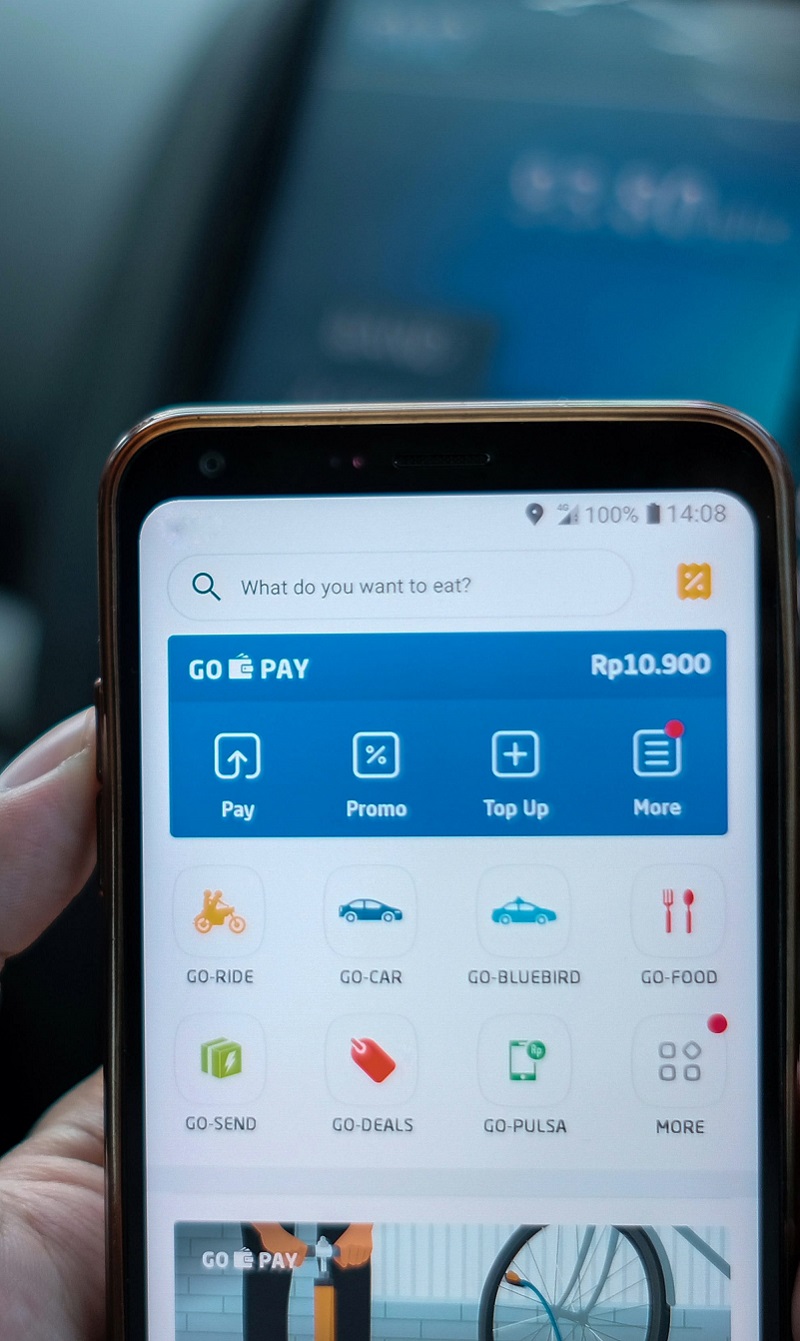

‘We’re now seeing less glamorous but equally sound shariah-compliant infrastructure investments across the United Kingdom from international investors. Not only in the retail sector but new innovative products and services such as retakaful and online 24/7 shariah-compliant investment platforms [similar to Islamic fintech like Finerd which offer services around the clock],’ he adds.

With the increase of the middle class Muslim population in the United Kingdom, Wayne says, there’s also an increase in demand for sophisticated financial products. ‘Islamic fintech, as it develops, will help meet some of this demand,’ he says.

Competency and alternative banking solutions

‘As Islamic finance institutions in the United Kingdom work on developing new products and standard contracts for Islamic transactions, familiarity with Islamic concepts will grow and their use will increase. This will drive down costs.

‘As products are developed for the Islamic retail sector, investment pools will grow and these will need to find destinations for investment,’ he explains.

But would Islamic finance replace conventional finance? Wayne believes Islamic finance already provides an alternative to conventional finance but because of the nature of conventional financial products, it can’t be replaced by Islamic products.

‘We’ve seen the use and growth of Islamic finance across the globe, not just in Muslim countries but also in non-Muslim or secular nations that have issued sovereign sukuk. In the UK we have Islamic, banking, mortgages, takaful, retakaful and crowdfunding competing with conventional schemes,’ he says.

Convergence with ethical finance

The convergence of Islamic and conventional finance institutions would require Islamic products to abide by the fundamental principles of shariah compliance. ‘But, there’s room to converge on other areas outside the jurisprudence of a shariah board like contracts, length and terms of repayment, legal certainty, ownership and regulation. We should aim to end up where there’s little or no difference in cost in issuing a sukuk or a conventional bond,’ Wayne says.

With ethical finance, it’s important to know the difference. ‘This is important as there’s little legal definition of, or regulation relating to, what qualifies as ethical products,’ he says.

Although all Islamic finance products should be ethical, there are Islamic finance products that are not managed within wider shariah principles. ‘Related to this is an individual’s own moral compass. For example, a manufacturer of bottled water in the UK, provided it met all the ethical and environmental stipulations could be ethical and Islamic. The same manufacturer meeting the stipulations might also produce whisky. I, as a non-Muslim, would still regard it as ethical. Other non-Muslims who do not approve of alcohol might not,’ Wayne explains.

If all is ethical

The drive behind ethical or Islamic finance is an attempt to make the world a better place and to help organise the larger scheme of things in the world. For Islamic finance to really drive the global financial situation to a better place, there would be risks involved.

‘I’ve heard that if all financial transactions had been Islamic we would have avoided the global economic crash, this is nonsense but there’s a growing interest in green, ethical and Islamic products.

‘We’ve to have risks in some financial products but by making financial systems more transparent, fair and responsible, then we create a safer and healthier business environment,’ he says.

With recent changes across the Middle East and North Africa (MENA) region and the wider Islamic world, more social roles need to be taken by Islamic finance institutions to help elevate the region’s economic situation. Wayne sees the latest developments in the United Kingdom as an opportunity to strengthen ties with the MENA region and other non-EU jurisdictions.

He advises Islamic finance institutions to take advantage of this new enthusiasm. ‘The halal economy now embraces life, politics, education, food, fashion and social reforms. Islamic finance institutions should find solutions compatible with the new Muslim values that are also compatible with global trends,’ he concludes.

___________________

Photo by Abi Ismail on Unsplash.